Probate Administration made clear—guidance for executors and families from day one

When a loved one passes, you need a steady, responsive team. We guide personal representatives (executors) and families through every step—court filings, notice to heirs and creditors, inventory and valuation of assets, debt resolution, tax coordination, distributions, and final accounting—so you can focus on family while we keep the estate on track.

- Prepare and file petitions, letters, and required court documents accurately and on time.

- Provide required notices to heirs, beneficiaries, and known/unknown creditors; manage claims.

- Assemble, inventory, and appraise bank, investment, real estate, and personal property assets.

- Coordinate tax filings (estate, income as needed) and keep records for court-ready accountings.

- Distribute property according to the will or state law and close the estate efficiently.

Who we help in probate

We support the people responsible for moving an estate forward—and those with rights in the estate. Clear guidance and steady communication reduce stress and prevent costly missteps.

Personal representatives (executors)

From first filings to final accounting, we handle the legal mechanics so you can fulfill your duties with confidence and avoid personal liability.

Heirs and beneficiaries

Understand what to expect, when distributions may occur, and how to address disputes or delays with practical, respectful advocacy.

Trustees & successor trustees

Coordinate trust administration alongside probate, align titling/beneficiaries, and maintain records that stand up in court.

Creditors and claimants

Clarify claim deadlines, documentation, and priority rules so legitimate debts are handled appropriately under the law.

Out-of-state family

Manage Colorado estates remotely through secure portals and scheduled calls; we coordinate local asset work and court appearances.

Busy professionals

We drive the timeline, keep you informed, and minimize disruptions with efficient, checklist-driven administration.

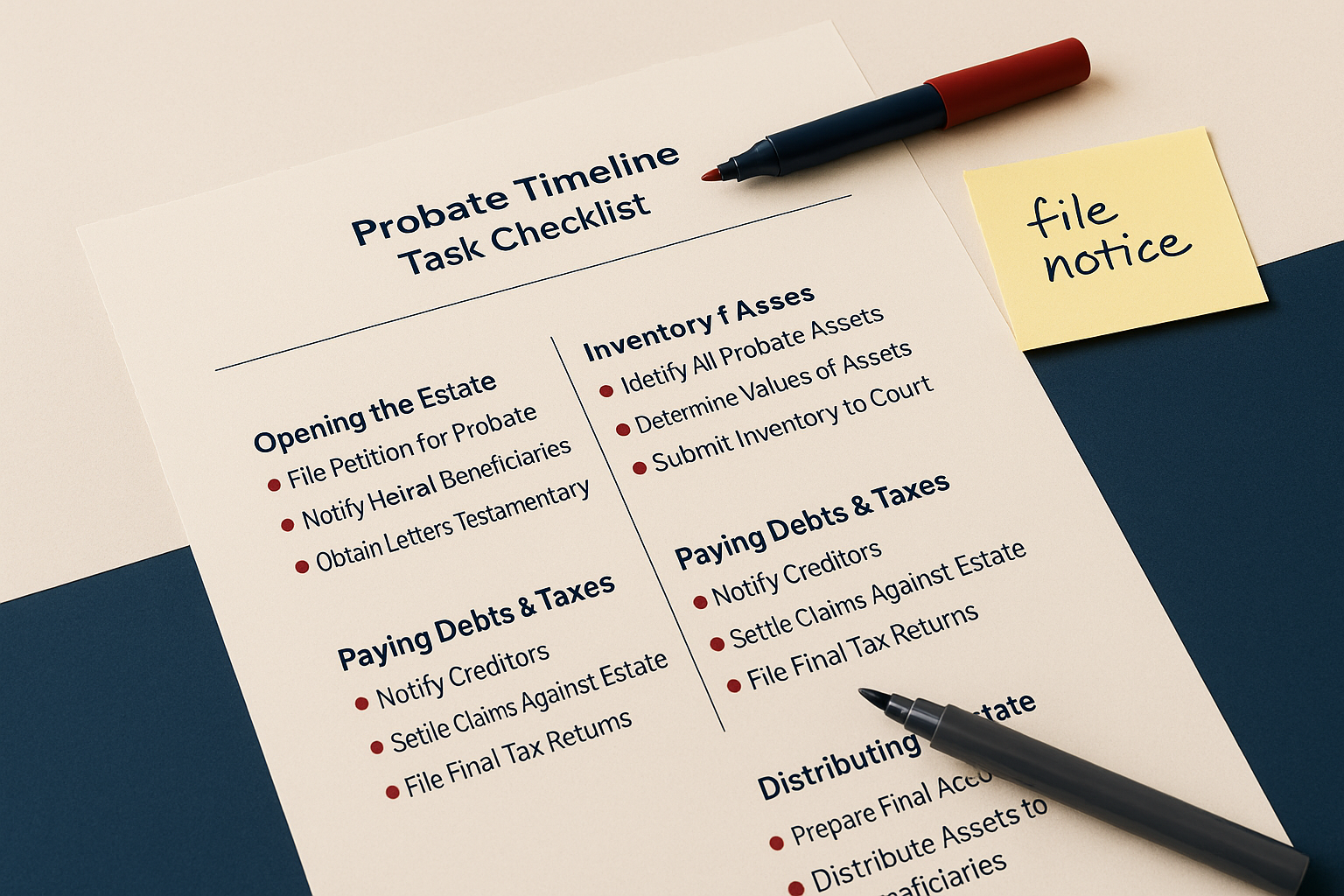

Process & timeline—what to expect

- Appointment: File the petition, obtain letters of appointment, and secure estate property.

- Notice: Provide notice to heirs/beneficiaries and publish or deliver creditor notices as required.

- Inventory & appraisal: Identify, value, and document all probate assets; coordinate appraisers when needed.

- Claims & debts: Review, accept, reject, or negotiate creditor claims; resolve liens and obligations.

- Taxes: Prepare applicable returns and obtain clearances where required; track step-up basis considerations.

- Distributions: Make interim or final distributions per will or intestacy after obligations are satisfied.

- Accounting & closing: Submit court-ready accountings; request discharge and close the estate.

Timeframes vary by court, asset mix, and disputes. We outline milestones upfront and keep you informed at each step. For a firmwide overview of how matters flow, visit Our Process .

Want a neutral primer on probate terms? See the Legal Information Institute’s overview at law.cornell.edu .

Complex probate issues we manage

Some estates are straightforward; others involve disputes, missing information, or multi-jurisdictional puzzles. Our cross-practice experience in real estate, insurance, business, and litigation helps resolve complications efficiently.

Will contests and disputes

Assess standing, evidence, and settlement options before litigating undue influence, capacity, or execution defects.

Missing assets or records

Trace accounts, deeds, policies, and titles; work with institutions and, when needed, forensic professionals to locate information.

Multi-state property (ancillary probate)

Coordinate ancillary proceedings for out-of-state real estate or business interests with local counsel as rules require.

Businesses within estates

Value and transfer closely held entities, address buy-sell or operating agreements, and keep operations stable during administration.

Beneficiary disagreements

Facilitate communication, mediation, or court guidance to keep the estate moving and protect fiduciary duties.

Insolvent or debt-heavy estates

Apply statutory priority rules, exemptions, and negotiations to manage limited assets while minimizing risk to the executor.

Fees & engagement—clear terms before we begin

Probate matters are billed hourly or via hybrid arrangements depending on complexity and anticipated scope. After reviewing the file and goals, we provide an estimate and a written engagement letter outlining tasks, decision points, and reporting cadence. Our approach emphasizes cost-sensitive strategies without sacrificing compliance or accuracy.

- Transparent estimates after initial review; detailed scopes in writing.

- Efficiency-first workflows, with task delegation to the right level of support.

- Regular updates so you can plan family and financial steps confidently.

Probate Administration FAQs

Practical answers to the most common questions we hear at the start of an estate.

Need timely probate help? We’re ready.

We’ll confirm conflicts, outline next steps, and provide a practical timeline for filings, notices, and distributions. Local to Castle Rock and Denver Metro with expanding coverage.

Page last updated: September 12, 2025