Bankruptcy & Debt Relief — Reset your finances with a clear, lawful plan

Facing overwhelming debt or relentless collections? We help individuals choose between Chapter 7 (debt discharge) and Chapter 13 (court‑approved repayment), and guide businesses through practical restructuring options—so you can protect essentials, reduce stress, and move forward with confidence.

- Eligibility and “means test” assessments with plain‑language guidance.

- Protection of exempt assets where permitted by law; strategy for vehicles and homes.

- Preparation and filing of petitions, schedules, and plan documents to reduce errors and delays.

- Creditor communications, meeting‑of‑creditors preparation, and timelines you can rely on.

- Coordinated advice with real estate, tax, and business considerations when your matter spans multiple areas.

Based in Castle Rock and serving the Denver metro, with a national expansion plan.

Who we help

Individuals, families, and business owners looking for a realistic way to manage debt, protect critical assets where allowed, and rebuild financial stability.

- Wage earners seeking structured repayment under Chapter 13

- Consumers overwhelmed by medical bills, credit cards, or personal loans

- Homeowners facing foreclosure or HOA arrears who need a plan

- Small businesses evaluating reorganization vs. wind‑down

- Individuals after a major life event (job loss, divorce, illness)

Matters we handle

- Chapter 7 liquidation for qualifying consumers and sole proprietors

- Chapter 13 repayment plans to catch up on mortgages and vehicle loans

- Business debt strategy, workouts, and litigation coordination as needed

- Defense and resolution of garnishments, levies, and collection actions

- Insurance, tax, and real estate alignment when debts cross practice areas

Our approach: right‑sized relief, asset awareness, and clear next steps

We map your income, assets, and debts to the relief that fits—without surprises. You’ll understand your exemptions, how secured debts are treated, and what to expect at each milestone. When your matter touches real estate, tax, or litigation, we coordinate to protect your broader interests.

- Plain‑language explanations of Chapters 7 and 13

- Organized document gathering with checklists and templates

- Proactive communication with creditors and trustees

- Realistic credit‑rebuilding tips post‑discharge

For neutral primers, the U.S. Courts provide helpful “Bankruptcy Basics” overviews at uscourts.gov .

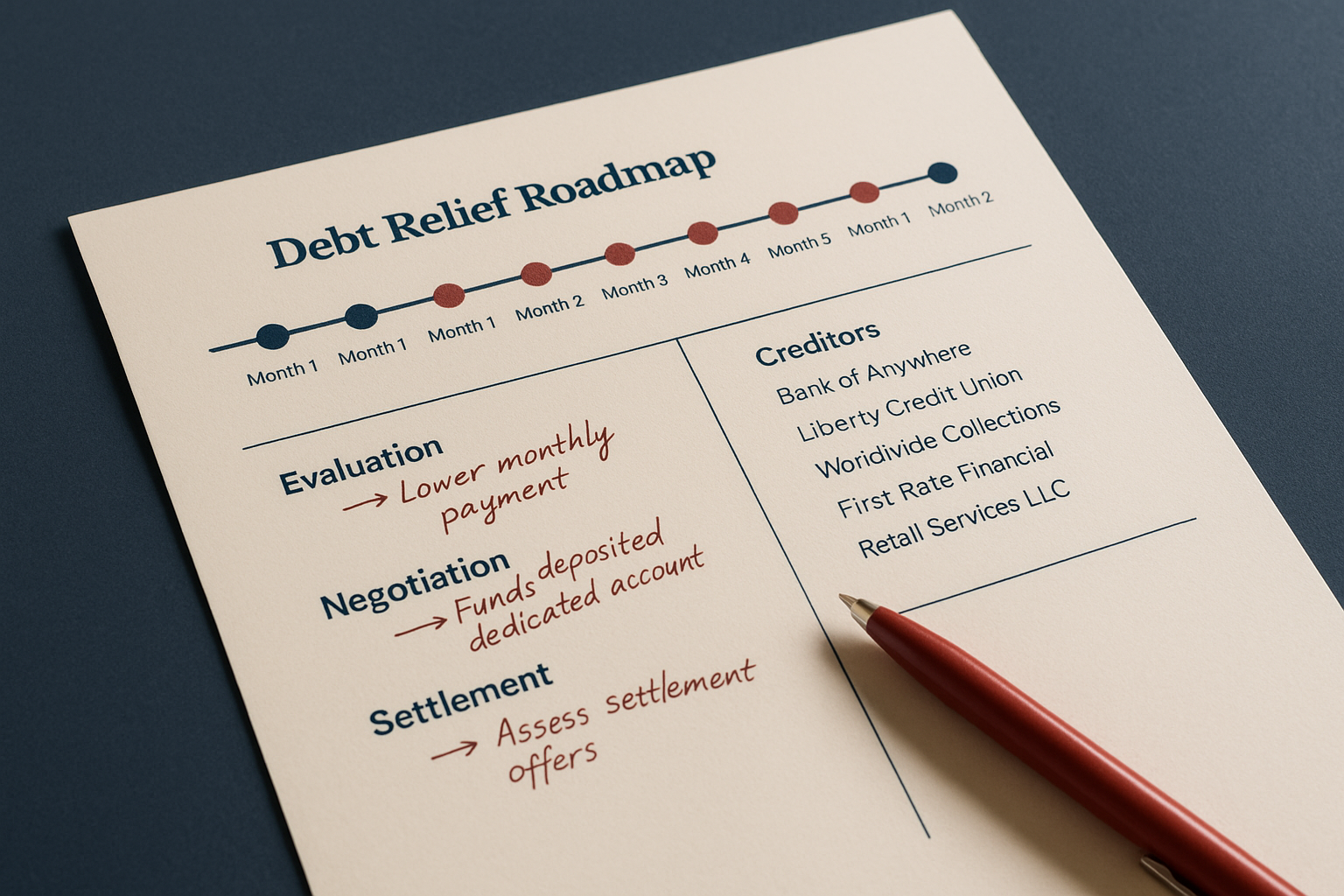

Process & timeline

Individual bankruptcy steps

- Consultation and eligibility review (including means test)

- Document collection and credit counseling certificate

- Petition and schedules filed; automatic stay typically begins

- Meeting of creditors (341 meeting) preparation and attendance

- Plan confirmation (Chapter 13) or administration (Chapter 7)

- Debtor education course and discharge if granted

Business restructuring essentials

- Cash‑flow and debt inventory; evaluate reorganization paths

- Vendor and lender communications; forbearance/workouts where viable

- Filing strategy, plan development, and stakeholder alignment

- Ongoing reporting, negotiations, and confirmation steps

Timelines vary by court, debt mix, and complexity. We set expectations early and keep you informed.

Fees & billing

We provide transparent fee structures matched to your matter. Many Chapter 7 cases qualify for flat or staged fees; Chapter 13 matters are scoped with plan‑based considerations. Business engagements are estimated and phased. Every representation includes a written scope so you know what’s covered.

- Clear quotes after eligibility review and document triage

- Predictable add‑ons for urgent filings or complex creditor issues

- Written terms, billing cadence, and regular status updates

What impacts cost?

- Debt mix and number of creditors (secured vs. unsecured)

- Assets, exemptions, and any non‑exempt equity questions

- Mortgage arrears, repossessions, or pending foreclosure timelines

- Business operations, payroll, leases, or pending lawsuits

- Urgency of filing and completeness of documentation

Documents checklist

Start with what you have—we’ll prioritize the rest. Having these ready accelerates eligibility review and filing accuracy.

- Government ID and recent pay stubs or income records

- Last two years of tax returns (or as requested)

- List of all creditors, balances, account numbers, and collection letters

- Bank statements, retirement account summaries, and insurance policies

- Real estate deeds, mortgage statements, HOA notices, and vehicle titles

- Any pending lawsuits, garnishments, levies, or judgments

Frequently asked questions

Straight answers to common eligibility, asset, and credit concerns.

Get a fresh start—talk to a bankruptcy lawyer today

On your first call, we outline eligibility, fees, and a realistic timeline. You’ll leave with clear next steps and a plan to protect what matters most.

Page last updated: September 12, 2025